Your home buying journey starts here.

Conductor is the new all-in-one platform for planning, financing and buying homes in Aotearoa, New Zealand.

-

Get a lending estimate in 2 mins

We can handle any circumstance you throw at us. Figure out what you could borrow in 2 mins

-

Chat to us about anything on your mind

We make the time to hear your questions and concerns - call, text, email, or easily book a chat using our live availability calendar

-

No endless forms or trawling through bank statements

Our software makes it simple to import, automatically classify and organise your spending - ready for submission

-

Buying a house doesn't need to be a full time job

We can help you engage a lawyer, review properties, sort your mortgage, arrange insurance and make a competitive offer

First Home Buyers

Free, no-obligation, hassle free advice to help get you into your first home.

-

Our custom platform means no trawling through your bank statements to figure out how much you spend on groceries or filling out long tedious forms.

-

No more negotiating a time to chat, your advisor’s diary is an open book, easily book a call anytime something comes up

-

We are here for the whole journey, acting as both your financial advisor and project manager - coordinating the legal stuff, insurance, and building inspections - and working with your accountant for contractors!

-

It’s not just about which lender to choose, but how to manage changing interest rates and optimising paying off your mortgage with the least pain - not to mention negotiating the best rates and cash back for you

Selling and Buying

Take the headache out of the logistics of your big move. Free, no obligation advice.

-

We can answer all your questions about the pros and cons of each approach, and ensure there are no surprises from your lender

-

Break fees, cashback clawbacks, application fees, moving banks - let us negotiate for you, so you know you are getting the best deal

-

Our custom platform means no trawling through your bank statements to figure out how much you spend on groceries or filling out long tedious forms.

-

No more negotiating a time to chat, your advisor’s diary is an open book, easily book a call anytime something comes up

Investors

-

Our software and expert advisors can help you figure out the financials of investing in property and navigate changing lending rules

-

No matter how you want to invest, we can seamlessly help you structure your lending, and link you with great legal advice to ensure everyone’s needs are covered

-

Interest deductibility, lump sum payments, interest only, loan terms - we listen to your goals and provide you creative options to match

-

We can help you coordinate the legal stuff, insurance, and any required building inspections - even a property manager if you need one

A trusted advisor to help you successfully navigate the process. Free, no obligations.

Refixing and Refinancing

From helpful advice on your ideal fix lengths to improving your loan structure. Free, no obligations.

-

Floating or fixed terms? One tranche or more? Let us advise you on the options that best match your goals

-

The added flexibility of offset or revolving credit accounts might be the ideal addition to your lending structure - especially for contractors

-

We can help you consider the lending implicating when using family trusts - and link you up with great legal advice to make it happen

-

Whether that be with your current lender or shopping around we can help you find and negotiate the best deals for you

Co-ownership

-

We can walk you through how co-owning a property with family or friends might work for you and how lenders will assess you. We can also link you up with great legal advice to protect everyone involved

-

One of the benefits of co-ownership is sharing the burden of coming up with the deposit. Alongside linking you with great legal advice, we can facilitate conversations to ensure your co-buyers stay on the same page

-

Paying down your mortgage is likely to be your co-buying team’s largest expense. We can help you all understand those costs, facilitate discussions, and compile your lending application to the banks - avoiding pitfalls along the way

-

Co-ownership is a growing trend, but it’s still not common. It’s also an area with some of the largest differences between the lenders, both in how they assess applicants and the rates you might quality for - let us guide you through those choices

Buying with friends, linking up with family? We can help you navigate the entire process.

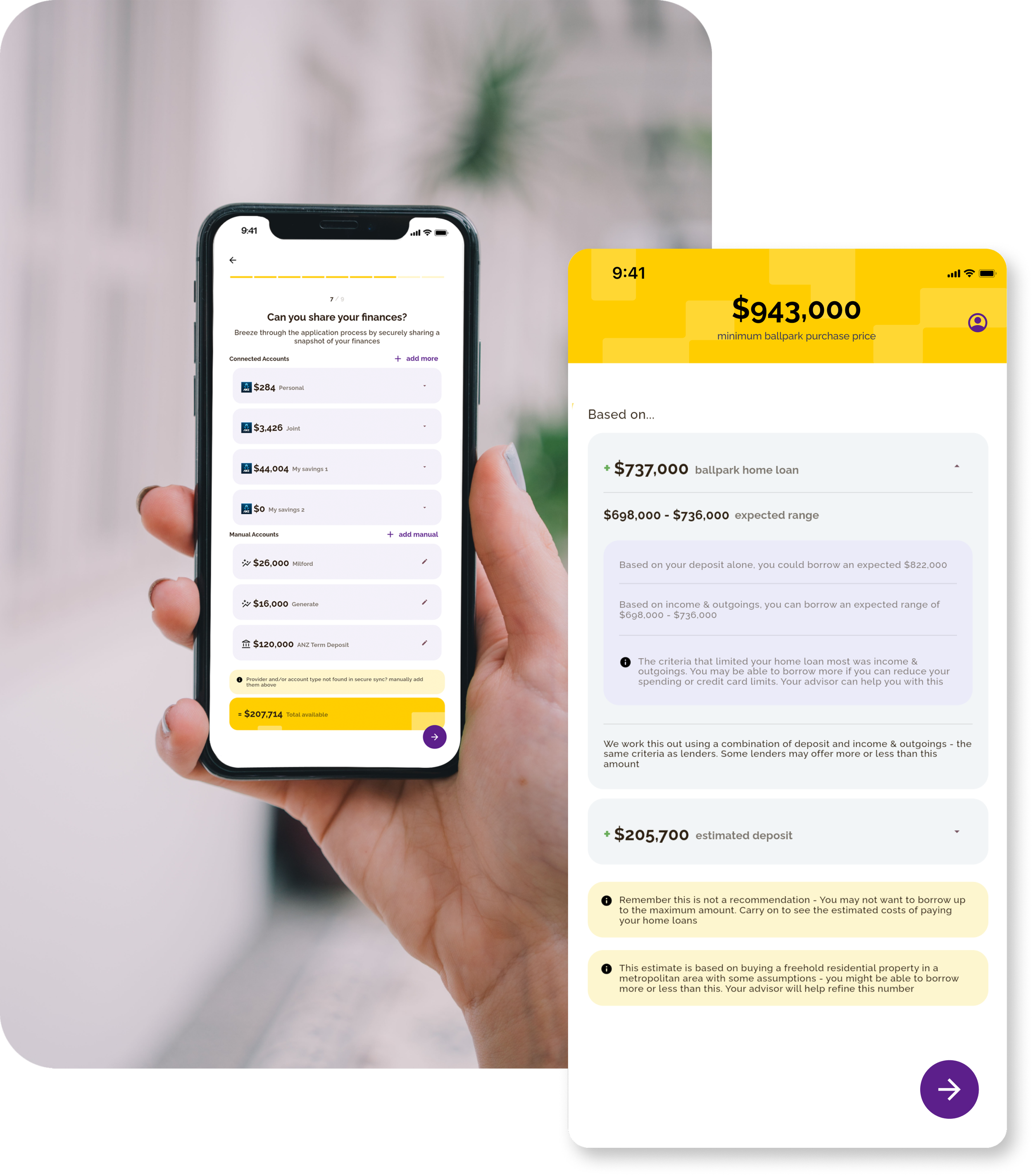

Instant

clarity.

Get free instant access to your personalised lending estimate before speaking with an advisor.

Conductor uses New Zealand’s open finance platform, Akahu, to securely obtain a snapshot of your financial position.

Make it happen.

Get mortgage approval through the Conductor platform, with an advisor available to speak any time.

Get your lending estimate.

With you

all the way

Once you find your dream home, we’ll be with you all the way — ensuring a smooth, streamlined process into your new home.

More Lenders, more choices

“It feels like you designed this with us in mind.”

Ewan D.

“It really streamlined the whole process.”

Ryan R.

“It’s very easy to use and gives great info.”

Angus W.